Acceptance of an asset in place of a money legacy. But is this official inflation rate of 35 an accurate representation of what is actually experienced by the people.

Gini Coefficients Before And After Taxes And Transfers In Oecd Download Scientific Diagram

Duty to notify and posthumous assessments.

. However in recent years there have been talks of reintroducing inheritance tax by successive governments. By compounding this 35 rate annually for 43 years the minimum value of the property from RM20000 in 1977 would have increased to RM87794 in 2020. There is no inheritance tax in Malaysia.

She now lives with my dad in this house. Inheritance tax in Malaysia was abolished in 1991. Time within which application must be made 5.

Graph of house price trends in Malaysia Where to by property in Malaysia. There is currently no inheritance tax in Malaysia. Property tax Property tax is levied on the gross annual value of property as determined by the local state authorities.

Effect and form of the order 6. Power of court to order payment out of net estate 4. This means that in Malaysia there is no final tax on the accumulated wealth of a deceased individual.

This tax is also not the same as an inheritance tax tax on propertymoney inherited which does not exist in Malaysia. Asset Inherited from deceased person. There are no inheritance estate or gift taxes in Malaysia.

The tax that needs to be paid basically applies for individual taxes and not business tax. Inheritance Inheritance tax and inheritance law in Malaysia Taxation Researcher April 04 2022 INHERITANCE No inheritance or gift taxes are levied in Malaysia. This enables you to find out the amount of RPGT payable in Malaysia quickly so that you can enjoy the best tax savings available.

Until then net worth exceeding MYR2 million US543000 was taxed at five per cent and a rate of 10 percent was imposed on net worth exceeding MYR 4 million. Even if there are no difficulties with having many beneficiaries or with finding them the application of the intestacy law in Malaysia will create other difficulties as shown below be it the Distribution Act 1958 or the Intestate Succession Ordinance 1960. My mom owns a house in Malaysia.

An estate of a deceased was liable to a five per cent tax if it was valued above RM2 million and 10 per cent if it was above RM4 million. But is this official inflation rate of 35 an accurate representation of what is actually experienced by the people. However this legislation was repealed in 1991.

Inheritance tax in Malaysia was abolished back in 1991. Its previous version was revoked back in 1991. Malaysia used to have the Estate Duty Enactment 1941 which served like the inheritance tax.

Gift of an asset on death. The prime reason was due to poor tax collection as the tax was only applicable to a specific threshold and was only applicable when a person died. Do you have to pay tax when you inherit your share of your inheritance.

The house insurance bill tax sent a fine under dads name and mum said she had to pay extra RM30 because bill was not settled on the date my dad passed away. There is currently no tax for property inheritance in Malaysia. Variation of orders 039efm Page 3 Monday March 27 2006 326 PM.

We do not have the inflation rate of Malaysia from 1977 until 2020 but for arguments sake we will use a prudent rate of 35. Currently Malaysia does not have any form of death tax estate duty or inheritance tax. LHDN can legally collect tax even after someone dies.

4834 Views Asked 21 Years Ago. Date of transfer of asset. However it was abolished 1991.

LAWS OF MALAYSIA Act 39 INHERITANCE FAMILY PROVISION ARRANGEMENT OF SECTIONS ACT 1971 Section 1. Asked on Apr 2 2001 at 1850 by. But with that being said it is ideal for a beneficiary of inherited property to know the ownership transfer date of the property and its market value at that point in time.

By compounding this 35 rate annually for 43 years the minimum value of the property from RM20000 in 1977 would have increased to RM87794 in 2020. Malaysia - More data and information How high is income tax on residents in Malaysia. Date of transfer of asset.

In addition the intestate will not be able to dictate the terms of the distribution of their estate to the people chosen to be. By compounding this 35 rate annually for 43 years the minimum value of the property from RM20000 in 1977 would have increased to RM87794 in 2020. An inheritance tax was implemented in Malaysia under the Estate Duty Enactment 1941.

At the time assets of a deceased individual valued beyond RM2 mil was subject to an estate tax between 05 and 10. Varies depending on category of the heir and the amount of the inheritance. 151 rows Gift tax rates vary based on the region where the gift is registered and range between 3 and 7.

Luxury and excise duties Excise duties are imposed on a selected range of goods manufactured and imported into Malaysia. Costa Rica does not have an inheritance tax. As of Budget 2020 no new laws on inheritance tax have been.

The quick answer is no. There was an estate duty in place until 1 November 1991 when it was abolished. During that time net worth assets exceeding RM2 mil were taxed at 5 and 10 on net worth assets exceeding RM4 mil.

Donation tax due to the local municipalities in the range of 33 to 66. Property prices in Malaysia. Short title and application 2.

Elaborating on capital gains tax Koong said the new proposed tax system would spook. Heres something to take note of before we go on. Inheritance Laws in Malaysia.

Market value of the asset as at the date of transfer less the sum referred to under Paragraph 41a 41b or 41c Schedule 2 RPGTA.

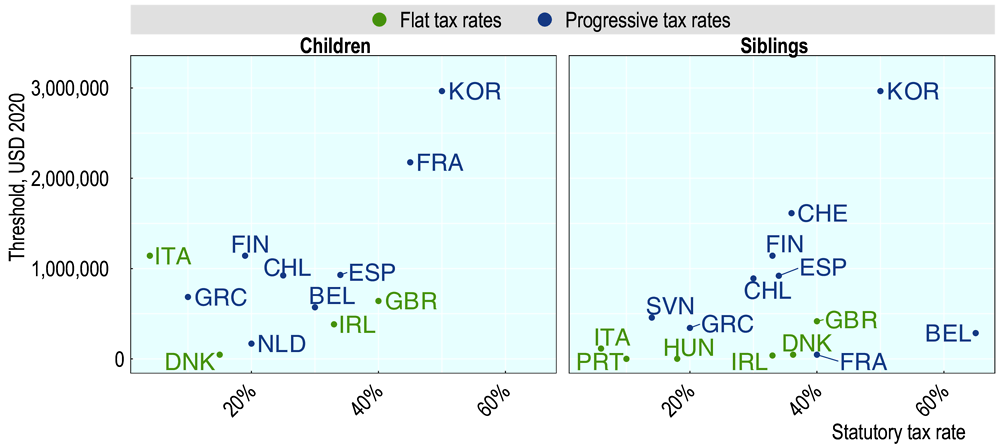

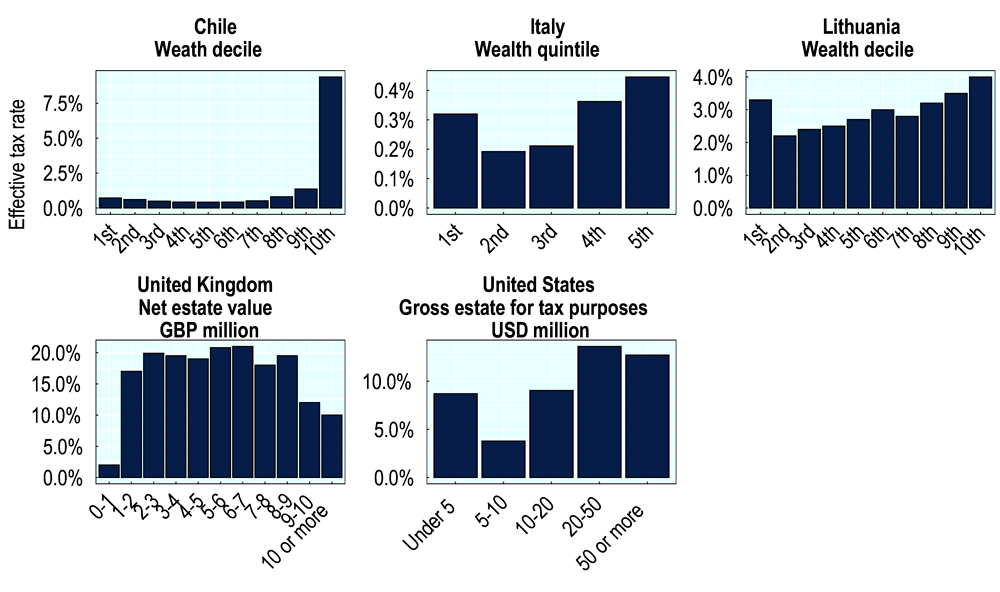

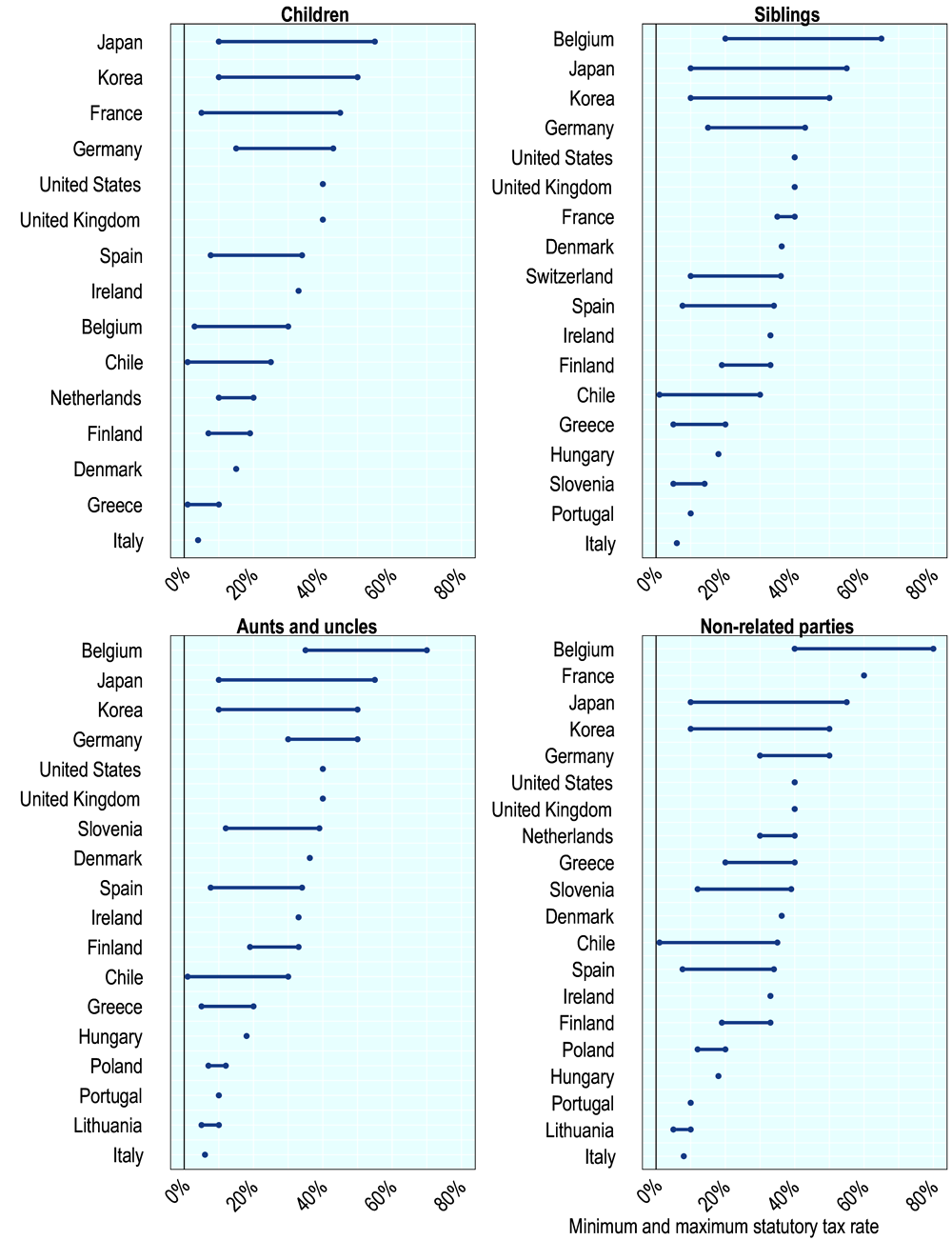

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Inheritance Taxation In Oecd Countries En Oecd

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

白金地产广告展板背景板ai广告设计素材海报模板免费下载 享设计

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Bkash Mobile Money Job Opening Good Communication Skills Job

How To Establish A Tax Policy Unit In Imf How To Notes Volume 2017 Issue 002 2017

These 22 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Business Insider Business Insi Money Concepts Finance Estate Planning

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Budget 2020 It S Time For Wealth And Inheritance Tax

Tax Experts No Need For Capital Gains Inheritance Taxes

How To Establish A Tax Policy Unit In Imf How To Notes Volume 2017 Issue 002 2017

Understanding Inheritance And Estate Tax In Asean Asean Business News

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Us Tax Rates Thresholds Adjusted For Tax Year Kpmg Global

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary